Metro Calgary House Price Forecast up to December 2020

Prices in Metro Calgary are continuing their downward path but are still expensive relative to local incomes. At this point, price declines appear to be part of a long-term trend in Metro Calgary as the market searches for the equilibrium price level.

Whereas people in Vancouver and Toronto like to compare their home markets to San Francisco, Manhattan, Sydney, Stockholm, and London. We believe Calgary is best compared to Houston, TX and Fargo, ND. Houston and Fargo have experienced a lot of growth recently and prices have risen…but prices in these markets are significantly lower than in Calgary.

This article covers:

How did Calgary home prices perform last year?

Where are prices headed in 2020?

Why are prices behaving this way?

What should sellers do?

What should buyers do?

How did Calgary home prices perform last year?

In December 2018, we forecasted that by December 2019 prices of all property types would drop by 1 to 3%. Condo prices have already dipped almost 1% to $250,000 and are set to drop further in the slow fall market. Single-family house prices have risen 2% to $490,000 in Calgary’s hot springtime market but, like 2017 and 2018, prices are also expected to drop every month between now and December.

Where are Calgary home prices headed in 2020?

In the past few years, Calgary home prices have consistently dropped 2% every year and future conditions appear to be more of the same if not worse.

First, the price of oil has languished for the past few years, sitting close to half the price it reached in 2008. The pipeline through British Columbia that would bring Alberta bitumen to new markets and add new buyers remains delayed in consultation. US buyers, who have a stranglehold on Alberta oil, have pushed the price of Western Canadian Select oil lower than other global oil prices. Finally, the US has begun reducing interest rates and this devalues the U.S. dollar; since oil is priced in dollars, the value of oil sold in Canadian dollars could drop 5 to 10%. Since close to 25% of Alberta’s economy driven by Oil and Gas, the province and Calgary should expect current economic conditions to be the new normal.

In contrast to the frenetic condition real estate markets back in the boom times, today’s market feels depressed, but it’s actually balanced. The market is very healthy right now however it appears that short-term shortages between 2005 and 2007 inflated home prices above the level sustained when demand moderates and is balanced. As a result, prices have been drifting slowly downward since 2015, seeking out the equilibrium price level.

Before going further, we need to make it clear that forecasts are intelligent guesses and history has often proven forecasters wrong. For example, in 2016 Royal LePage (a major real estate brokerage) predicted that Vancouver house prices would drop 8% in 2017, but instead, the benchmark detached home price rose $100,000 from $1.5 million to $1.6 million. If you hear of a forecast this year that sounds too good to be true and unbelievably accurate (e.g., estimating to the dollar), then likely it is.

Looking forward to 2020, we are in line with most forecasters who expect prices to drop and the brunt of price drops will likely be felt by higher-priced properties (i.e., more expensive neighbourhoods and detached single-family homes). Homebuyers and homeowners shouldn’t expect much price appreciation between now and the end of 2020.

Frustrated with your current realtor? Find a realtor and mortgage broker who shares your priorities and specializes in your local area.

Why are Calgary Home prices dropping?

Trending Towards a Balanced Market

What does this mean exactly? Well, the market for all homes (detached, townhome, condo) are all trending toward a position where buyers and sellers have equal power. In the past, because the population in Calgary was growing more quickly than the supply of homes, it was a “pressure cooker” seller’s market and prices shot up dramatically. Now that the pressure is turned off, buyers can leverage the healthy levels of supply to negotiate discounts and incentives. The positive outcomes for buyers are lower prices, more selection, fewer bidding wars, and ultimately a little less stress.

Foreign Capital is Moving From Western to Eastern Canada

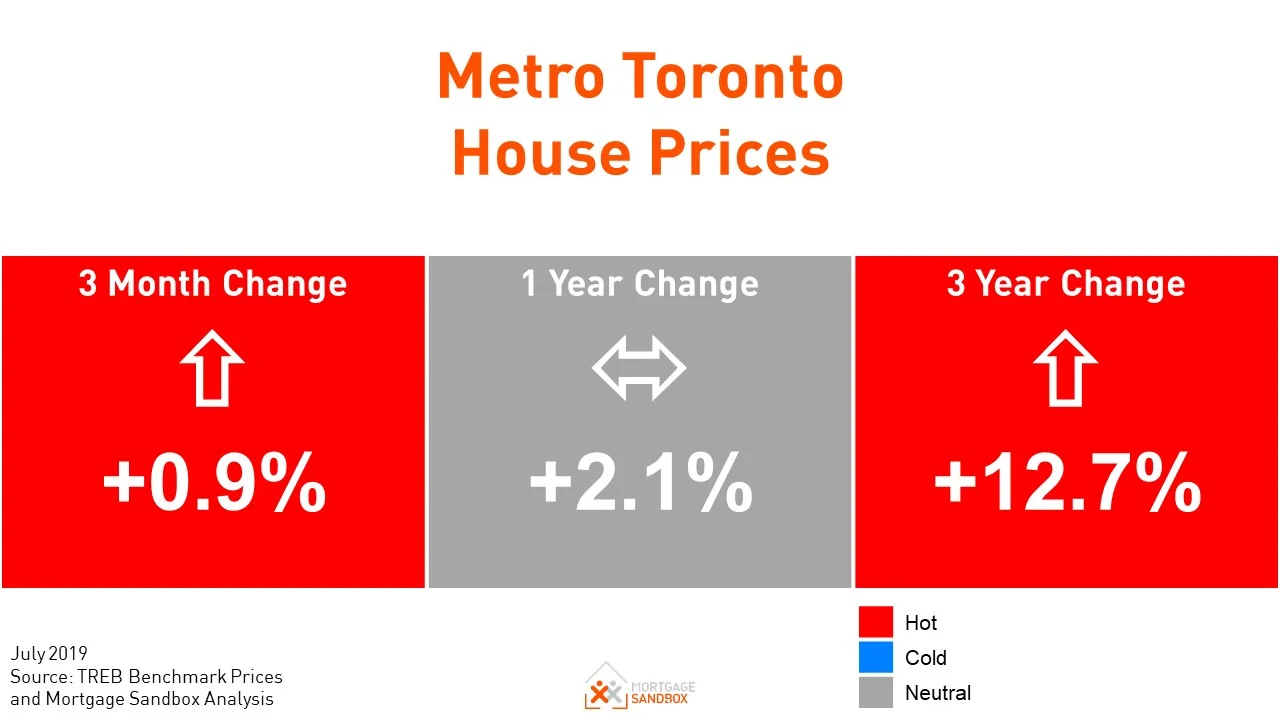

The foreign money that used to pour into Calgary appears to have moved to Toronto, Montreal, and Ottawa. In particular, the Ottawa real estate values have grown dramatically, smashing through past records.

Metro Calgary house prices seem cheap when compared to Vancouver and Toronto, but are very expensive when compared to Fargo, ND or Houston, TX. The median home value in Houston is $188,700. Houston home values have gone up 5.0% over the past year and Zillow predicts they will rise 2.5% within the next year. The price of a benchmark Calgary house is more than double the price of a median home in Houston.

Other factors driving the slow-down

At Mortgage Sandbox, we break down our market analysis to five key factors: affordability, capital flows, government policy, supply and popular sentiment. Read the full report to understand how these factors are affecting prices in Metro Vancouver.

What should Home Buyers do?

Metro Calgary buyers have equal negotiating power and their power has been growing. So long as you aren’t taking on an uncomfortable amount of debt and this is your “forever home”, it is a good time to buy. You may save a bit of money waiting for prices to drop further but the savings likely won’t be as great as the cost of paying rent.

At the end of the day, a home is a place to live more than it is an investment. If you feel you need a home to have the lifestyle you’ve always wanted, then now is the best time since 2009 to be a buyer. Just be sure to drive a hard bargain and keep in mind that prices will likely continue to drop after you buy your home. It’s impossible for everyone to perfectly time the peaks and troughs of the market.

What should Sellers do?

Real estate holds more uncertainty for sellers. Current forecasts would indicate that the longer you wait the less you’ll get for your home. In the early 1990s, Toronto saw a dramatic real estate correction and it took almost 20 years for prices to match their previous peak. There’s no guarantee that’s the case in Calgary but if you don’t like risk and you know you need to sell in the next 5 years, it may be prudent to list earlier rather than later.

For the latest market information for Metro Calgary bookmark our Metro Calgary Real Estate Insights and Forecast page.

Conclusion

In summary, we think prices could drop between now and December 2020. However, because of the annual seasonal real estate price cycle, prices typically have more upward pressure between January and June, then stabilize in late summer before prices soften under the downward pressure exerted in Fall and Winter. If you’re looking to buy your first house, now is as good a time as any to buy. If you own a condo or townhouse and want to upgrade to a house, we expect the price gap between houses and other homes to get larger between now and 2021. As an investor, be cautious of the risks present in the current market.

Sources: