Metro Toronto Home Price Forecast - Jan 2021

HIGHLIGHTS

|

This article covers:

Where are Metro Toronto prices headed?

What factors drive the price forecast?

Should investors sell?

Is this a good time to buy?

1. Where are Metro Toronto home prices headed?

Home Price Overview

Metro Toronto has a population of roughly 6.8 million and was ranked 13 of the best 100 cities in the world.

Metro Toronto house prices have accelerated significantly in the past few months, which has pushed more potential home buyers out of the house market. At the same time, condo values have dropped.

This trend can’t continue for long since condos are traditionally the first step on the “property ladder.” If a condo is the primary source of a house buyer’s downpayment, then house prices will eventually be pulled down.

People planning to sell their home will take heart because home values are near all-time highs.

Given the current recession and the second wave of infections, sellers may want to push ahead and sell during the pandemic. With the negative economic impacts still mounting, there is no guarantee that home prices will maintain current values over the next two years. Typically home prices drop during a recession.

The Coronavirus Pandemic, the resulting recession, and the potential for a third wave of infection are now the primary source of uncertainty for home values.

GTA Detached House Prices

House price growth in Metro Toronto has accelerated through 2020. The “soft landing” that government policymakers were targeting has not materialized, nor have promises of a ‘market crash.’

We believe politicians are hoping to guide the market toward a typical annual real estate cycle with price growth in the range of 1 to 3% annually – in line with income growth.

It seems unlikely that record house prices will be sustained through the next 12 months based on economic fundamentals. So far, buyer sentiment has overwhelmed the core fundamentals.

Market Risks

House price growth in Toronto has been very high. Overall, according to the CMHC, there is a moderate risk of a price correction in Toronto.

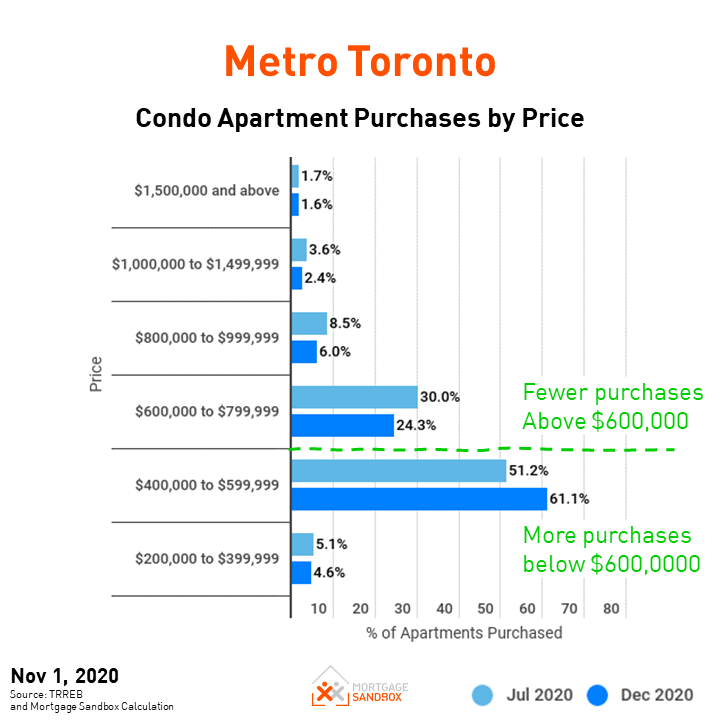

Metro Toronto Condo Apartment Prices

Metro Toronto apartment prices are falling, but total purchases are consistent with prior years.

Overall, condos are not falling out of favour however, there are two key differences:

There are fewer buyers for luxury condos.

Condo apartment supply is abundant - particularly in downtown Toronto.

With more people working-from-home, we expect developers will begin marketing larger (i.e., 2 and 3 bedrooms) apartments to meet buyer preferences. As the supply of more generous floor plans comes to the market, it may depress the values for small floor plan condos.

At Mortgage Sandbox, we would like developers to build 4 and 5 bedroom condos because:

Not everyone can afford to buy a house for their family.

Canadians who now work from home need more room to segregate workspace from living space within their homes.

Many Canadians with longer working hours find it challenging to stay on top of necessary house upkeep (i.e., mowing lawns, clearing eaves, shovelling sidewalks).

Many people prefer to live in higher-density neighbourhoods with all the essential amenities within walking distance.

In a city like Toronto building a house usually entails tearing down a house. Building houses results in more waste and fewer new homes.

Still a challenge for first-time homebuyers

Toronto home prices are not affordable.

A first-time homebuyer household earning $78,000 (the median Metro Toronto household before-tax income) can only get a $320,000 mortgage. For them to buy a condo apartment valued at the benchmark price of $590,000, a homebuyer needs to save a little more than $270,000 cash for a down payment and closing costs or receive a very generous gift from family. For most people, that is just not possible.

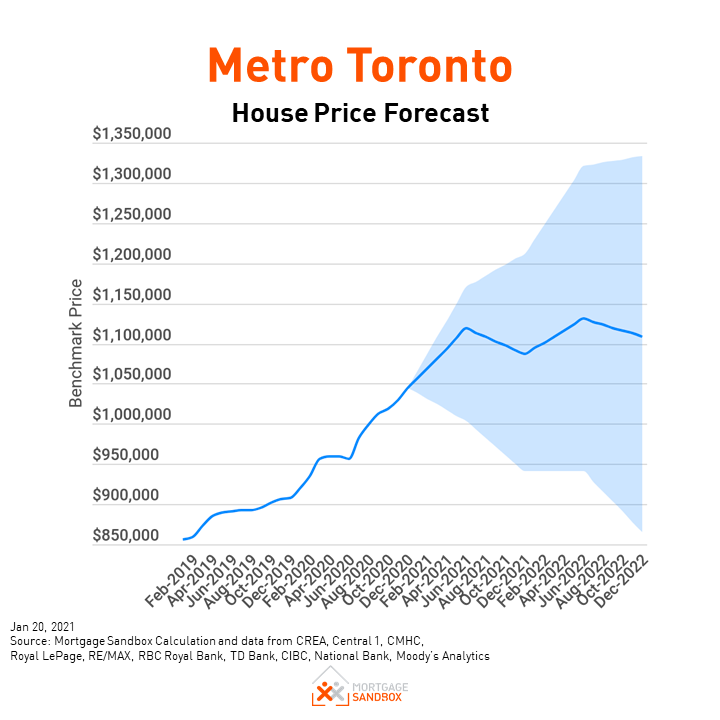

2021 Metro Toronto House Price Forecast

There is a lot of uncertainty in the forecasts for 2021 and 2022. Many of the forecasters we've surveyed have different expectations for:

How likely is the third wave of COVID-19 infections and associated restrictions?

Will the economy will re-open in the 'new normal' in June or December 2021?

Will the federal government succeed in achieving its aggressive immigration targets during a pandemic and with high unemployment?

Since the mortgage payment deferrals expired in October, will the anticipated distressed home sellers appear in the housing market?

As a result of their varying assumptions, some forecasters expect prices to continue rising, while others expect are more likely prices to drop.

For example:

Central 1, the economists for the credit unions, predicts Toronto prices will rise 7% in 2021.

The highest forecast in a September Reuters poll of 16 economists was price growth of 16% in 2021, while the lowest prediction called for an 11% drop.

Moody's Analytics, which develops mortgage risk software for Canadian banks, predicts an 8.75% drop in Toronto.

Moody’s has't attempted to pinpoint the timing of the decline in values. However, our research shows that most past declines in Canadian home values have begun between May and July. Traditionally, there is less supply (fewer listings) between February and May, which puts upward pressure on prices.

CMHC, the government housing agency, predicts a ‘peak-to-trough’ drop of between 6% and 19%. They expected government aid and mortgage deferrals would cushion the blow in 2020 and that the market would be impacted in 2021 with a 2022 recovery.

There is no consensus among economists. Market sentiment and government stimulus have led to price acceleration and record home purchases even though most economic fundamentals have faltered.

We tend to place a little more weight on CMHC and Moody's Analytics. They may be projecting lower values in the future, but:

CMHC sells insurance to banks to help limit their losses if a mortgage goes bad.

Moody’s Analytics sells software to banks to help them assess the risk of their mortgage portfolios.

Both organizations are unique in their ability to see market conditions across the regions and all the banks.

In the next section, we examine the five factors that drive these forecasts. They will help explain why several forecasters are anticipating price drops.

For a more thorough comparison of the Coronavirus Recession to the Great Recession, and potential impacts on property prices, check out our recent article: “Should I sell my home today?”

At Mortgage Sandbox, we provide a price range rather than attempting a single prediction because many real estate risks can impact prices. Risks are events that may or may not happen. As a result, we review various forecasts from leading lenders and real estate firms. We then present the most optimistic estimates, the most pessimistic prediction, and the average forecast. Do you want to learn more about real estate risk? We've written a comprehensive report that explains the level of uncertainty in the Canadian real estate market.

Our forecast inputs:

2. What factors drive the price forecast?

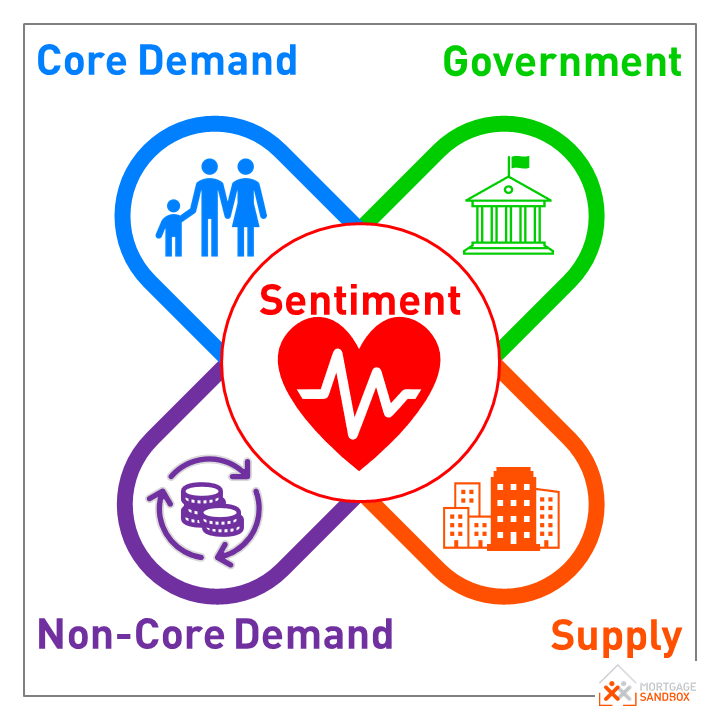

Mortgage Sandbox 5 Forces Framework

At the highest level, supply and demand set house prices and all other factors simply drive supply or demand. At Mortgage Sandbox, we have created a five-factor framework for gathering information and performing our market analysis. The five key factors are core demand, non-core demand, government policy, supply, and popular sentiment.

In the long-run, the market is fundamentally driven by economic forces. Still, sentiment can propel prices beyond economically sustainable levels in the short-run.

Below we will summarize how the five factors result in the current Toronto forecast. We also have a report on the five factors driving home prices across Ontario.

Core Demand

Core demand is a function of:

Population Growth: The pace at which people are moving to an area. An average of roughly 2.5 people live in one household.

Home Price Changes: Changes in the market value of the desired home.

Savings-Equity: How much disposable after-tax income you’ve been able to squirrel away plus any equity you have in your existing home.

Financing: Your maximum mortgage is calculated using income, monthly expenses, and interest rates.

Population Growth

Ontario’s population is almost always growing, but the rate of growth is important for our analysis.

If population growth is the same or lower than in the past, then there is less upward pressure on prices.

At the moment, population growth is lower in Ontario and in the last three months of 2020, the population actually contracted. As a result of ongoing COVID-19 related travel restrictions, we may observe lower growth through to mid-2021.

READ: Fewer People = Less Demand : Easing Population Growth to Weigh on Housing, TD Bank

Home Price Changes

House prices are near records across Metro Toronto. Prices growth reduces affordability and reduces the pool of qualified potential buyers. In an ironic twist, this means rising prices create downward pressure on prices.

As a rule-of-thumb, homeownership costs are considered unaffordable when they exceed 40% of household income.

In March 2020, Toronto homeownership costs were 68% of the median household income. In other words, Toronto's home prices had exceeded economic fundamentals in a lower interest rate environment before the Coronavirus impact.

However, given that prices are already very high, the current price increases will not make homes significantly less affordable.

Savings-Equity

Equity

Existing condo owners seeking to trade-up benefited from price appreciation until mid-2020, so they have more home equity to use when buying a bigger home.

However, condo values have been falling recently, and this is eating into the equity available for a move to a townhouse or house.

Savings

Rents were rising faster than incomes, so first-time buyers struggled to come up with down payments.

The stock market dropped because of the pandemic, so anyone who managed to save a down payment and invested it in ‘blue-chip stocks’ may now find out they’ll need to save for a few more months or years.

Financing

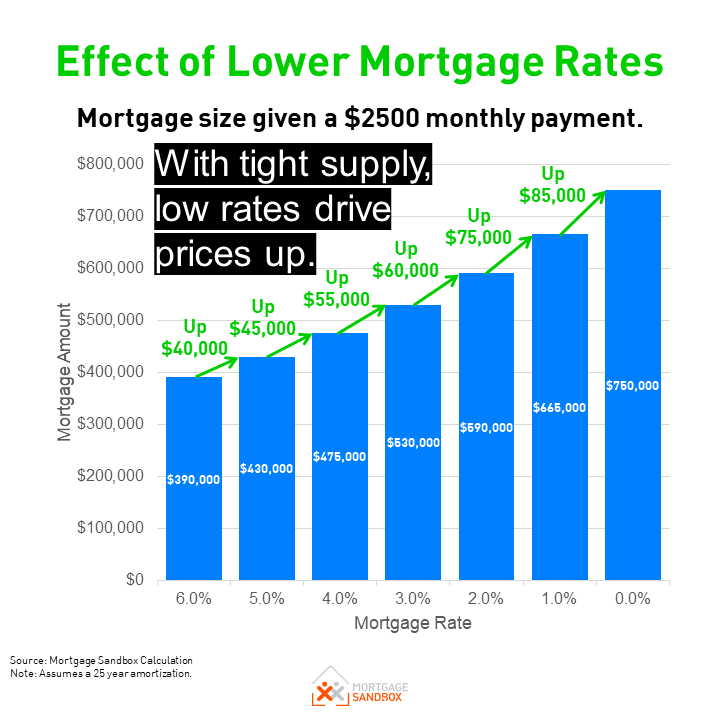

Mortgage Interest Rates

The Bank of Canada may reduced rates dramatically, but mortgage qualifying interest rates haven’t fallen nearly as much. Also, lenders have tightened their borrowing guidelines. Overall, lower rates have not increased home-buying budgets very much.

Employment and Incomes

As well, nearly half (47%) of Ontarians are still experiencing COVID-related disruption to their employment. Job losses from Coronavirus containment efforts are a more powerful force than low mortgage rates. Without income, you can not qualify for a mortgage.

Brendan LaCerda, a Senior Economist with Moody’s Analytics, estimates that each 1% rise in unemployment results in a 4% drop in home prices. Until now, the impact of unemployment has been delayed by the CERB and mortgage payment deferral program.

Using this ratio, a prolonged 2.5% rise in Toronto unemployment from 5.4% to 7.9% would result in a 10% price drop. A 5% rise in Ontario unemployment to 10.4% would lead to a 20% fall in values.

Overall, Toronto’s employment levels are much worse than in most Canadian cities.

Even after people get re-hired, they will need to be on the job for three months before they qualify for a mortgage pre-approval. Small businesses and commission salesforce have to show 2 years of consistent income to be eligible for a mortgage. Unless banks change their lending policies, 2020 will drag down their mortgage qualifying income until mid-2023 (when they file their 2022 taxes).

Homeownership Costs

City revenues have been hit hard by the pandemic, and while the provincial and federal governments may provide support, homeowners will likely be expected to help as well. Residents should expect property tax increases or reduced services to make up for the pandemic revenue shortfalls. If cities put off infrastructure and capital spending, then the deferred costs will eventually result in higher taxes.

Property taxes are factored into your mortgage affordability calculations, so an increase in taxes lowers home-buying budgets.

Overall Core Demand

Despite lower interest rates, due to the Coronavirus' impacts, short-term core demand for homes will likely be much lower as we head into 2021.

Non-Core Demand

This represents short-term investment, long-term investment, and recreational demand (i.e., homes not occupied full-time by the owner). Here is where foreign capital, real estate flippers, and dark money come into play. It also includes short-term rentals, long-term rentals, and recreational property purchases.

Since non-core demand is ‘optional’ (i.e., not used to shelter your own family), it is more volatile than core demand.

Short-term Rentals

International travel restrictions will make many short-term rentals unprofitable for the foreseeable future. Statistics show that, since the travel restrictions were put in place, international travel to Canada has dropped 98 percent.

Fewer investors will be buying real estate for short-term rentals until travel restrictions are lifted.

Foreign Capital

Ontario implemented a 15% foreign buyer tax to reduce the distorting effect of Foreign Capital flows on local real estate.

With the international travel restrictions that are part of Coronavirus containment efforts, we can expect very little foreign investment in Canadian real estate.

Long-term Rentals

Nearly 40% of Toronto’s condos are not owner-occupied, so rental investments are a significant home price driver.

Recent reports of rents falling across Canada will discourage new rental investment until rental rates stabilize.

House Flipping

With rising uncertainty, house flipping has become riskier. We expect many professional flippers will stay away from the market until it stabilizes.

Dark Money

Dark money is the proceeds of crime or money that are transferred to Canada illegally. This includes money earned legitimately that is illegally transferred from countries with capital controls (e.g., China) and legitimate earnings moved from countries subject to international sanctions (e.g., Iran, Russia, and North Korea).

To hide the illegal nature of the funds, it is laundered in the real estate market. Sometimes, the property's true owner is hidden by using a Straw Buyer, and other times the property is owned by a shell company.

Sometimes a real estate agent or lawyer will accept the illegal cash to help the nefarious individuals hide its true origins. In 2015, a B.C. realtor was caught with hundreds of thousands of dollars in her closet at home.

We see no evidence of a diminished role for dark money in local real estate.

Overall Non-core Demand

Capital inflows toward residential real estate for non-core uses have declined. This reduces upward pressure on Metro Toronto home prices.

Government Policy

Governments have shielded Canadians and the housing market from the impacts of the pandemic induced recession using:

All of these programs, except for CEWS, have now expired.

Expansion of First-time Home Buyer Incentive (FTHBI) Program

Since it was launched in 2019, the FTHBI has struggled to gain traction among first-time buyers. As of Sept. 30, 2020, the program has received just 9,520 applications. Less than 1% of homes purchased in Canada were financed using this program. Under the program, the federal government helps first-time buyers with their down-payment but when the property is sold, the owner pays the government back their contribution plus a share of the lift in property value.

CMHC has announced they are expanding the program in Victoria, Vancouver, and Toronto to raise the maximum qualifying purchase price to about $720,000 in those three markets. In the rest of Canada, the maximum purchase price is $505,000.

The expansion of this very small program is unlikely to have much impact on the market.

Higher Property Taxes

The City of Toronto mayor and councillors approved slightly higher taxes and are debating new and higher taxes. City staff are studying the possibilities, and there are some of the ideas.

In December, the Toronto council voted to increase property taxes by 8 percent over 6 years. It will pay for transit and infrastructure, and its slow introduction will likely have little impact on the market.

In January, Councillor Ana Bailao pitched the idea of including an empty home tax in the city's 2020 budget, along with an increase to the municipal land transfer tax charged on luxury homes.

The Federal Government says it will take steps in 2021 to implement a tax on foreign homeowners who live outside of Canada. This is intended to help lower housing prices, but the experience in British Columbia shows that foreign ownership taxes and foreign purchaser taxes don’t conclusively lead to lower home values.

Over time, the layering of municipal, provincial, and federal taxes on non-resident owners may have an impact on the market.

Overall Government Influence

The government has now unwound many of the programs supporting home values through the recession. Compared to three months ago, there is now much less support from the government to maintain home values.

Supply

Supply comes from two sources.

Existing sales: Existing home sales are sales of ‘used homes’. They are homes owned by individuals who sell them to upgrade, move for work, or for some other reason. The local Realtor’s Association only reports existing home sales.

Pre-Sales and Construction Completions: Most new homes are sold via pre-sales before the construction has started. These are predominantly apartments and townhomes.

Months of Supply of Existing Homes

House supply is at historical lows, while condo supply in 2020 remained at the higher end of the 5-year range. This makes condo-buying conditions significantly more favourable for buyers.

Mortgage Delinquencies and Foreclosures

Data indicates that more Canadians are missing their monthly payments, and it appears more Canadians are over-extending themselves. Surprisingly, the increases in delinquencies are led by Ontario and British Columbia, and not Alberta.

According to Equifax, the credit bureau company:

“Mortgage delinquencies have also been on the rise. The 90-day-plus delinquency rate for mortgages rose to 0.18 percent, an increase of 6.7 percent from last year. Ontario (17.6%) led the increases in mortgage delinquency followed by British Columbia (15.6%) and Alberta (14.8%). The most recent rise in mortgage delinquency extends the streak to four straight quarters.”

A survey by MNP reported a staggering number of Canadians are stretched to their limits:

“Over 30 per cent of Canadians say they’re concerned that rising interest rates could push them close to bankruptcy, according to a nationwide survey conducted by Ipsos on behalf of MNP, one of the largest personal insolvency practices in the country.”

Statistics in August show that 12 percent of GTA mortgage holders could not make their regular mortgage payments. Mortgage deferrals expired at the end of October. Unless these borrowers have found new jobs or sold their homes, their mortgages will fall into default in early 2021.

Pre-sales and Completions

New Construction

There is a record number of homes under construction in Toronto, most of them are condos, and many are nearing completion. As these buildings complete in 2021 and 2022, and people move out of their rental or sell their current home, this new supply should alleviate some of the market's pressure.

Pre-sales

Metro Toronto pre-sales are purchases of brand-new homes from developers. Typically, a developer must sell 70% of homes in a building before they can start construction, so housing starts can also be a good indicator of successful pre-sales.

Pre-sales are robust in 2020, and the construction pipeline is expected to remain full for the next two to three years.

Popular Sentiment

Popular sentiment can be volatile and easily influenced by the latest headlines. Sentiment can shift quickly, as witnessed in the past two years.

Canadian Consumer Confidence

The Ipsos-Reid and Nanos Canadian Confidence Index showed a noticeable drop in 2020 and are now on the mend.

Canadian consumer confidence has improved significantly, buoyed by positive views on real estate. Half of Canadians believe home prices in their neighbourhood will rise over the next six months even though most expect the economy will still be in the dumps.

Although consumer sentiment is a key factor contributing to real estate price trends, consumer sentiment on its own is not an accurate predictor of prices.

Coronavirus Containment

Ontario is struggling to contain the second wave of infection, and we expect localized restrictions and lockdowns. The reimposition of restrictions will likely depress sentiment.

Canada has not yet flattened the curve on wave 2. Several vaccines have been approved and Prime Minister Trudeau has announced that, if all goes well, most Canadians will be vaccinated by September 2021.

Taking into account the time between now and September plus the spread of the UK and South African variants which are more infections, we should probably be preparing ourselves mentally for a third wave of infections before settling into the “new normal”.

The greatest controllable challenges at this stage are:

Anti-maskers - we should be happy to inconvenience ourselves if it means we can avoid the third wave of infection.

Vaccine supplies, shipping logistics, and set-up of enough vaccination sites.

Anti-vaxxers - a quarter of Canadians don't want to take the COVID-19 vaccine.

More than 25% of Canada’s population (almost 10 million people) is considered at higher risk.

Federal government guidance prioritizes early COVID-19 vaccination for the following groups:

residents and staff seniors’ care homes

adults 80 years of age and older, followed by adults 70 years older

health care and personal support workers

adults in Indigenous communities

As additional vaccines become available, inoculations will be extended to:

homeless shelters

correctional facilities

housing for migrant workers

essential workers who face additional risks to maintain services for the functioning of society

A study headed by Dr. Kristine A. Moore, medical director at the University of Minnesota Center for Infectious Disease Research and Policy, explored scenarios for the pandemic's evolution. Her research team predicted that the second wave in the Fall of 2020 was a likely scenario.

Now that we are in the midst of the second wave, we need to look ahead to what’s next.

Scenario 1 - Second Wave is the Last Wave

Canadians continue to follow health policy guidance and wear masks and continue social distancing until enough people are vaccinated to provide herd immunity. The second wave is the last.

Scenario 2 - Larger Third Wave in 2021

By May 2021, most of the vulnerable have been vaccinated, many Canadians will stop wearing masks and social distancing. They will hold the mistaken belief that vaccinating the most at risk is good enough.

Lax social distancing plus the introduction of more infectious COVID variants lead to the third wave of infections. The lives of many people who are vulnerable, but didn’t know it, would be at risk in this scenario. The provinces would likely have to reimpose local restrictions and lockdowns.

Businesses would have an opportunity to re-open between waves.

Scenario 3 - Extended Second Wave

As a result of the new more infectious variants and restriction non-compliance, we never truly overcome the second wave using social distancing. Instead, it is finally beaten using vaccinated herd immunity.

High case counts over an extended period of time mean that governments will leave restrictions in place for longer.

3. Should Investors Sell?

From a seller’s perspective, more market changes influence prices downward, so now may be a better time to sell than in two years, and the annual real estate cycle usually favours sellers in the first half of the year.

Sellers should always consult a mortgage broker early to prioritize flexible loan conditions and reduce the risk of mortgage cancellation penalties. Find out more about the benefits of a mortgage broker.

Planning to Sell? Check out our Complete Home Seller’s Guide.

4. Is this a good time to buy?

With accelerating prices, some homebuyers who took a cautious wait-and-see approach in 2019 may have been priced out of the market.

Prices are still trending upward, but Coronavirus containment efforts pull prices down. Prices will likely be lower in 2021. Keep in mind that the annual real estate cycle usually favours buyers in late summer.

The wild card is the Coronavirus. At this stage, it's difficult to determine how much it will impact the market.

If you are thinking of buying, be sure to drive a hard bargain and pay as close to market value as you can. As well, when it comes to financing, don't bite off more than you can chew.

Planning to Buy? Check out our Complete Home Buyer’s Guide so we can walk you through the end-to-end process and get you ready to buy your new home!

Here are some recent headlines you might be interested in:

New CMHC report says Canadian housing market could see a 14% plunge (The Star, Jan 21)

These are Canada's fastest growing communities as cities see record exodus (CTV, Jan 19)

Toronto rent was down 20.4 per cent in December while real estate sales were way up (NOW, Jan 19)

Pandemic housing boom means affordability is no longer just a big-city problem (Global News, Jan 16)

Toronto, Montreal see exodus pick up pace, aggravated by COVID-19 pandemic (Globe and Mail, Jan 22)

The stresses that changed Canadian and Ottawa real estate in 2020 (Ottawa Citizen, Jan 2)

COVID-19 has made reading next year's real estate market harder than ever (CBC. Dec 14)

Interim B.C. money laundering report out, but final inquiry results will be delayed (CTV, Dec 10)

Like this report? Like us on Facebook.