Canadian Mortgage Rate Forecast to 2027

Last updated:

HIGHLIGHTS

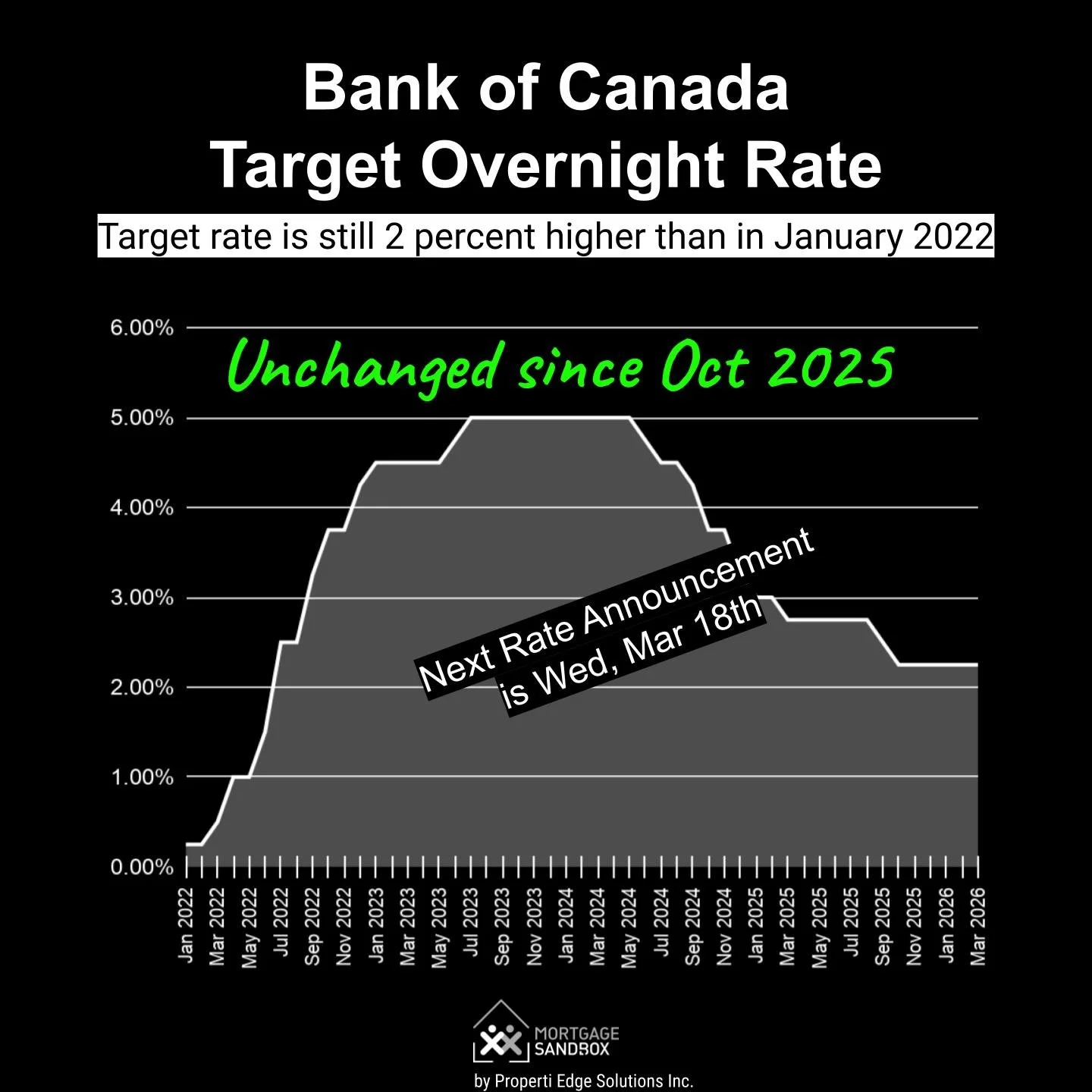

Bank of Canada On Hold: In January, the Bank of Canada (BoC) held its policy rate at 2.25%, where it has been since the last cut in October 2025. The consensus is that we are at the bottom of the rate cycle, with the central bank adopting a wait-and-see approach as inflation slowly cools toward its 2% target. The next BoC rate announcement in Wednesday, March 18th.

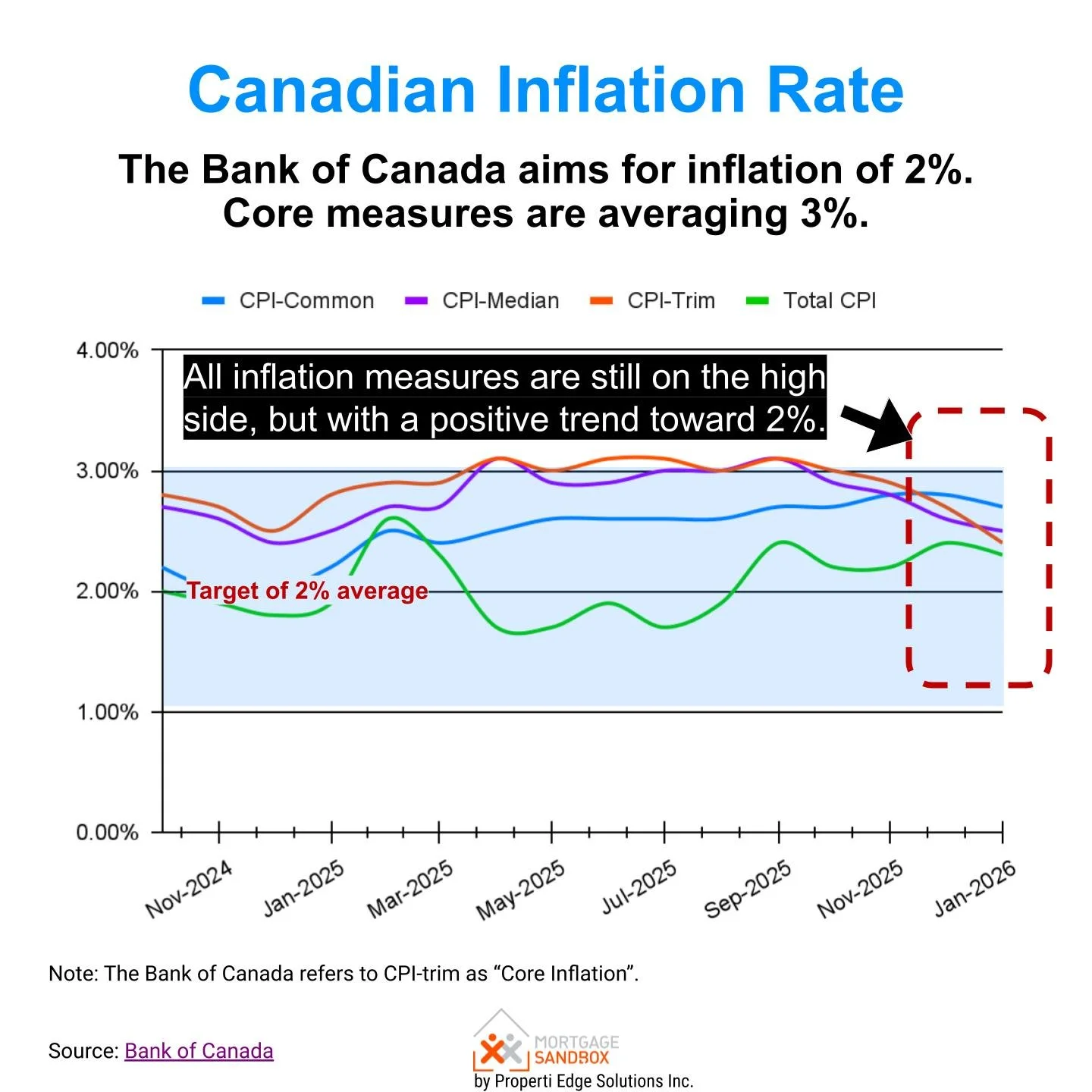

Inflation's Uneven Path: While headline inflation has eased, core inflation remains sticky. Food and services prices continue to apply upward pressure, meaning the Bank will likely keep rates steady for most of 2026.

Mortgage Outlook: Fixed rates are expected to rise slightly, while variable rates are expected to remain broadly stable until Mid-2026. Significant further declines in mortgage rates are unlikely for both in 2026, barring a major economic shift. The question for borrowers is, “When will rates begin to rise?”

The Critical Link: Your mortgage rate in 2026 is directly tied to inflation data. Monthly CPI reports will be the key signal for any future movements in bond yields and, consequently, fixed and variable rates.

Following a series of reductions in 2025, the Bank of Canada (BoC) has paused its rate-cutting cycle. With its key policy rate at 2.25%, the focus has shifted squarely to inflation's gradual and uneven return to the 2% target. For Canadian borrowers, understanding this path is crucial for making informed mortgage decisions through 2026 and into 2027. This forecast synthesizes the latest data and major bank projections to help you navigate the current rate environment.

Fighting Inflation

Having started rate cuts in June 2024, the Bank of Canada is carefully steering toward neutrality. Sustained inflation in a range of around 2% is crucial for anchoring price stability..

The Canada-China Trade Conflict

Following Prime Minister Mark Carney’s landmark four-day visit to Beijing, Canada has entered a "new strategic partnership" with China, signalling a significant shift in its trade diversification strategy. On January 16, 2026, the two nations reached a preliminary agreement to reciprocally ease trade restrictions: Canada will lower tariffs on a quota of 49,000 Chinese electric vehicles (EVs) to 6.1%, while China will reduce tariffs on Canadian canola seeds from 84% to 15% and lift barriers on other agricultural goods like lobster and peas.

This move serves as a dual-track strategy to insulate the Canadian economy from U.S. trade volatility while demonstrating that Canada has viable alternatives to American markets.

Beyond China, Carney’s administration is aggressively pursuing a "world as it is" approach, having recently secured a $70 billion investment commitment from the U.A.E. and actively reviewing a proposal from Sweden’s Saab for 72 Gripen fighter jets—a deal that promises 12,600 domestic jobs and challenges the planned purchase of U.S.-built F-35s. While these maneuvers aim to double non-U.S. exports by 2035, they have already drawn criticism from domestic auto manufacturers and warnings from U.S. officials ahead of the USMCA renegotiations scheduled for later this year.

The Bank of Canada Rate Forecast: A Pause for Assessment

Bank of Canada Policy Rate

The BoC's current stance is one of cautious stability. The rapid rate-cutting phase is over, and the central bank is now in a data-dependent holding pattern.

Its primary task is to ensure inflation is durably under control before considering any further policy adjustments. With core inflation metrics still showing persistence, the Bank is unlikely to provide the market with a definitive timeline for its next move, preferring instead to react to incoming economic data, particularly monthly Consumer Price Index (CPI) reports.

5-year Government Bonds

The direction of fixed mortgage rates is influenced by the yield of the 5-year Government of Canada bond. These bond yields reflect market expectations of medium-term economic growth and inflation. As inflation decreases, bond yields have stabilized from their previous highs. Most forecasts suggest that the 5-year bond yield and, consequently, the basis for fixed mortgage rates, have stabilized.

Sources

To develop our analysis, we’ve surveyed the most prominent Canadian banks and their forecasts.

Current Mortgage Rates in Canada

Recent Mortgage Rate Trends in Canada

Fixed Mortgage Rates

Fixed rates have retreated from their pandemic-era peaks but are unlikely to fall further.

Optimistic forecasts suggest that the five-year fixed rate could remain near 4.5% by the end of 2026 and 2027. It is possible the 5-year fixed mortgage rate will rise to 5% by the end of 2026 and 5.5% by 2028.

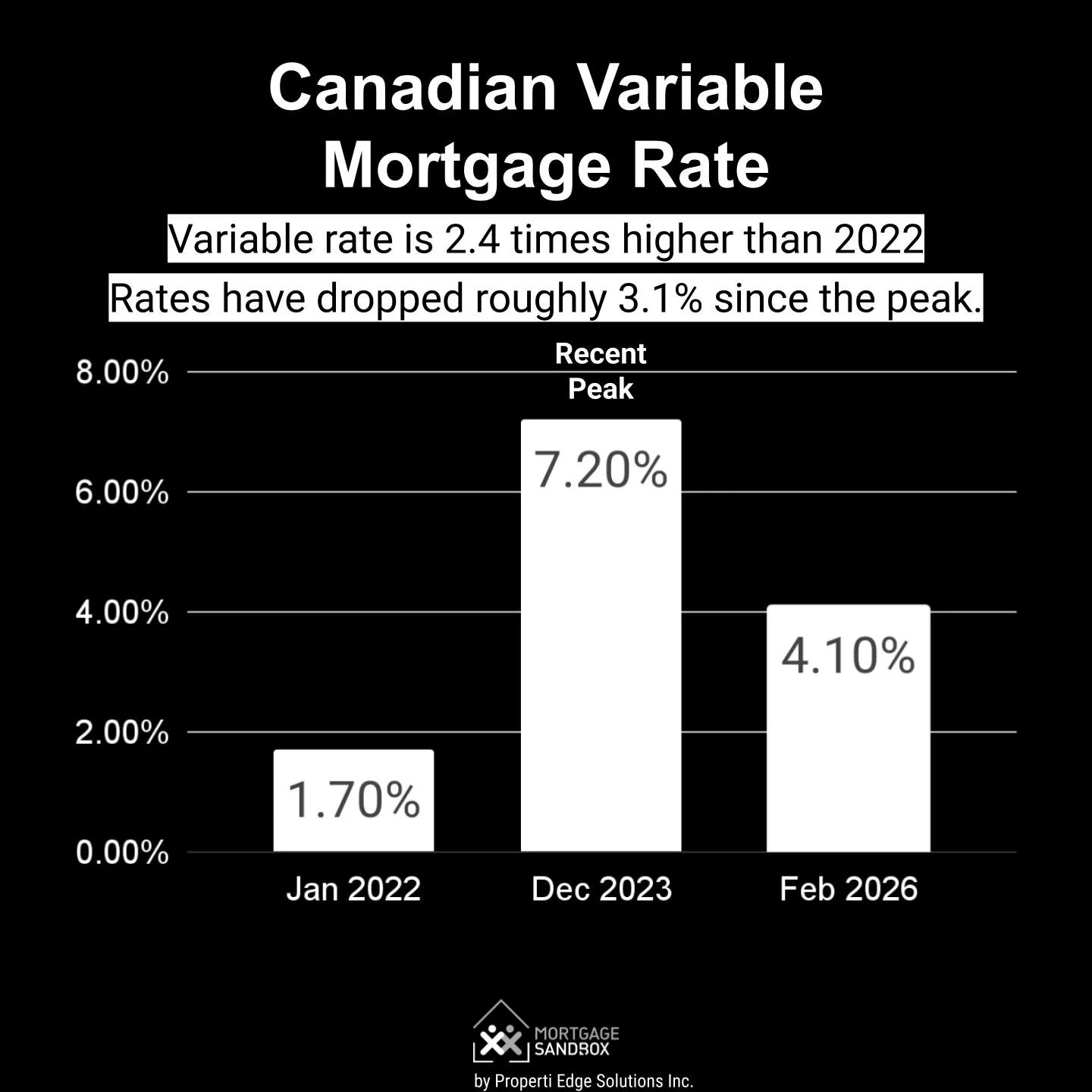

Variable Rates

Canada is at or near the bottom of this interest rate cycle.

During economic downturns, recessions, or periods of low inflation, central banks lower (ease) interest rates to stimulate borrowing and spending, boosting economic activity.

Some forecasts suggest the five-year variable rate could stay at 4.1% until 2028. More likely, it will rise before then.

Impact of Rates on Homebuyer Budgets

Higher mortgage rates reduce homebuying budgets.

Most forecasters expect rates to be higher in a year. Higher mortgage rates reduce buyer budgets, often pushing some potential buyers out of the market because their savings and income can’t buy what they used to.

It often takes 18 months for rate cuts to ripple through the housing market.

Need a mortgage refinance?Talk to one of our affiliated Mortgage Brokers Powered by Properti Edge |

Mortgage Rate Predictions Through 2027

Will the 5-Year Fixed Rate Fall Further?

It is unlikely. The typical 5-year fixed mortgage rate, which has already fallen significantly from its peak, is not projected to see substantial further declines. It is expected to hover near current levels for the foreseeable future. This stability stems from bond markets having already priced in the current economic outlook. A notable upside surprise in inflation could push these rates higher, while a sharp economic downturn would be needed to drive them meaningfully lower.

How much further will Variable Rates Drop?

Very little, if at all. Variable mortgage rates, which move with the BoC's policy rate, are directly tethered to the inflation fight. With the central bank on hold, variable rates are also expected to remain flat. Borrowers should not bank on the significant savings from rate cuts seen in 2025. The risk now is asymmetric: while further cuts are a remote possibility, a resurgence in inflation could force the BoC to consider raising rates again in 2027.

Try our mortgage offer comparison tool to calculate the dollar difference (not percent) between two offers. Find out how much cash you’ll save with a lower rate and the potential fees that come with different choices.

In Today’s Market, Is A Fixed or Variable Rate Better?

For those buying or renewing in early 2026, the strategic choice is nuanced:

The Case for Fixed: A 5-year fixed rate offers predictability in an uncertain climate. It shields you from potential future rate increases for a considerable period, providing invaluable budgeting certainty. This is a prudent choice for those who are risk-averse or believe inflation may prove more stubborn than expected.

The Case for Variable: A variable rate offers lower initial costs and the potential for decreased payments if the BoC eventually cuts rates. However, this comes with the clear risk of higher payments if the economic data forces the Bank's hand the other way. This option is suitable for borrowers with financial flexibility to absorb potential payment increases.

A Strategic Middle Ground: A 3-year fixed term has emerged as a popular compromise. It provides medium-term stability, bridging the current period of uncertainty. By the time of renewal in 2029, the path for inflation and rates is expected to be much clearer, potentially allowing for a more advantageous choice at that time.

Pros and Cons of a 5-year Fixed Rate Mortgage

Stability & Budgeting: Your principal and interest payment is locked in, immune to BoC rate hikes for five years. This is the primary benefit for peace of mind.

Protection from Inflation: If inflation rebounds, forcing rates up, you are insulated.

Higher Cost for Security: You typically pay a premium (a higher rate) for this stability compared to the initial rate on a variable mortgage.

Costly to Break: Breaking a fixed-rate mortgage before term can trigger a significant penalty, often based on the "Interest Rate Differential" (IRD). This makes it an inflexible option if you plan to sell or refinance early.

Not sure you've been offered a good renewal rate?Try our mortgage offer comparison tool Powered by Properti Edge |

Pros and Cons of a Variable Rate Mortgage

Lower Initial Rate: Variable rates typically start lower than fixed rates, saving you money in the short term.

Payment Decreases with Cuts: If the BoC lowers its rate, your interest costs (and often your payment) will fall accordingly.

Lower Penalty to Break: Penalties for breaking a variable mortgage are usually just three months' interest, which is often less than an IRD charge on a fixed mortgage.

Payment Uncertainty: Your monthly payment can increase, sometimes substantially, if the BoC raises rates. Your budget must have room to accommodate this.

Exposure to Inflation Risk: Your mortgage cost is directly tied to the central bank's battle with inflation. Stubborn inflation means higher payments for you.

Not sure you've been offered a good deal?Try our mortgage offer comparison tool Powered by Properti Edge |

How to Get the Best Mortgage Rate

Start Early & Use a Broker: Contact an accredited mortgage broker 120 days before your closing or renewal date. They have access to dozens of lenders and can negotiate on your behalf to find the best rate and terms.

Negotiate Your Discount: For variable rates, the advertised "prime minus" rate is negotiable. Don't just accept the posted discount; ask your broker or lender to improve it.

Consider More Than Rate: While the interest rate is critical, also evaluate the contract's flexibility (prepayment privileges, portability) and the penalty calculation for fixed rates.

Further Reading: Our mortgage renewal guide that will help you navigate the process.

Is it a better time to Buy or Sell a home?

The higher-rate environment has rebalanced many Canadian housing markets, moving them away from the extreme frenzy of recent years.

Advice for Homebuyers:

Your purchasing power is dictated by today's rates, not 2020's. Be realistic with your budget and get a solid pre-approval to lock in a rate. Focus on homes you can comfortably afford within the stress-tested framework. This is a market for diligent, prepared buyers.

Advice for Home Sellers:

The "list it and it sells" market has passed. Pricing your home correctly from day one is essential to attract serious buyers. Work with an agent who understands the localized impact of current financing costs on buyer demand. Well-presented, fairly priced homes are still selling.

Like this report? Like us on Facebook.

|

Do you have a financing strategy?Try our our Financing Strategy Explorer Powered by Properti Edge |

Canadian Real Estate Forecasts

Toronto

Real Estate Trends and Forecast

Montreal

Real Estate Trends and Forecast

Hamilton-Burlington

Real Estate Trends and forecast

Victoria

Real Estate Trends and Forecast

Vancouver

Real Estate Trends and Forecast

Ottawa

Real Estate Trends and forecast

Calgary

Real Estate Trends and Forecast

Edmonton

Real Estate Trends and Forecast

London, ON

Real Estate Trends and Forecast

Okanagan Valley

Real Estate Trends and Forecast

Like this report? Like us on Facebook.